Affordable Dental Care: Exploring Patient Financing Options

Are you ready to take a bite out of the financial burden of dental care? Just like a well-prepared meal, exploring patient financing options can leave you feeling satisfied and worry-free. But where do you start?

With a myriad of options available, from dental insurance plans to flexible payment options, it can be overwhelming to find the perfect fit for your needs. Don’t fret just yet, because in this discussion, we will unravel the mystery and shed light on the various avenues that can help you achieve affordable dental care.

So, sit tight and get ready to embark on a journey that promises to leave you smiling from ear to ear.

Dental Insurance Options

If you’re looking for dental insurance options, there are several providers that offer comprehensive coverage at affordable rates. These providers understand the importance of maintaining good oral health and want to make dental care accessible to everyone.

One option you may consider is Delta Dental, which offers a wide range of plans to suit your needs. With Delta Dental, you can choose from individual or family coverage, and they’ve a large network of dentists across the country.

Another option is Cigna Dental Insurance, which provides coverage for preventive, basic, and major dental services. They also offer a variety of plans to fit different budgets.

MetLife Dental Insurance is another reputable provider that offers affordable coverage. They’ve an extensive network of dentists and provide coverage for a range of dental procedures.

Lastly, Guardian Dental Insurance offers comprehensive coverage with affordable premiums. They’ve flexible plans that cater to individuals and families, and their network of dentists is extensive.

With these dental insurance options, you can ensure that you have the coverage you need for your dental care at an affordable price.

Flexible Payment Plans

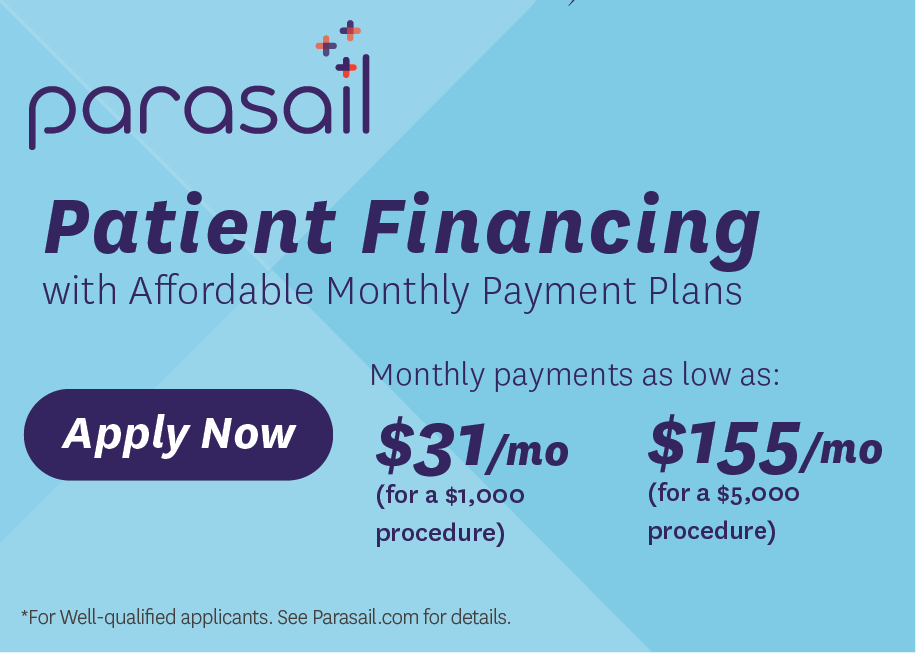

Now let’s explore an alternative financial option that can help make dental care more accessible: flexible payment plans.

These plans are designed to provide patients with a convenient way to manage their dental expenses by spreading the cost of treatment over time. With flexible payment plans, you can receive the dental care you need without worrying about the upfront cost.

Flexible payment plans work by allowing you to make monthly payments towards your dental treatment. This can be especially beneficial for those who may not have dental insurance or who require extensive dental work that may be costly. By breaking down the cost into manageable installments, you can receive the necessary treatment while still keeping within your budget.

One of the advantages of flexible payment plans is that they often have little to no interest, making them a more affordable option compared to traditional financing options. Additionally, these plans are typically easy to set up and can be tailored to fit your specific financial situation.

When considering a flexible payment plan, it’s important to understand the terms and conditions associated with the plan. You should inquire about any fees, interest rates, or late payment penalties to ensure that you’re making an informed decision.

Dental Savings Plans

Consider enrolling in a dental savings plan to help reduce the cost of dental care. Dental savings plans, also known as dental discount plans, are an affordable alternative to traditional dental insurance. These plans work by offering discounted rates on various dental procedures and treatments. Unlike insurance, there are no deductibles, waiting periods, or annual maximums with dental savings plans.

One of the key advantages of dental savings plans is their simplicity. You pay an annual membership fee and gain access to a network of dentists who’ve agreed to offer their services at reduced rates. This can be particularly beneficial if you don’t have dental insurance or if your insurance doesn’t cover certain procedures. With a dental savings plan, you can receive substantial discounts on routine check-ups, cleanings, fillings, crowns, and even orthodontic treatments.

Another advantage of dental savings plans is their flexibility. There are no restrictions on pre-existing conditions, and everyone is eligible to enroll. You can start using the plan as soon as you sign up, and there are no waiting periods for coverage to begin. Additionally, there’s no paperwork to fill out, and you don’t have to deal with complex claims processes.

Government Assistance Programs

Explore government assistance programs to help alleviate the financial burden of dental care.

When it comes to affording dental treatments, government assistance programs can be a valuable resource. One such program is Medicaid, which provides dental coverage for low-income individuals and families. Medicaid eligibility varies by state, but it generally covers essential dental services such as cleanings, fillings, and extractions.

Another option is the Children’s Health Insurance Program (CHIP), which offers dental coverage for children from low-income families who don’t qualify for Medicaid. Additionally, the Indian Health Service (IHS) provides dental services to Native American and Alaska Native individuals. These programs can significantly reduce the cost of dental care and make it more accessible to those in need.

In addition to these federal programs, some states offer their own assistance programs. For example, California has the Medi-Cal Dental Program, which provides dental coverage to eligible individuals. New York has the Child Health Plus program, which offers dental coverage to children from low-income families. It’s important to research and understand the specific programs available in your state to determine if you qualify for assistance.

Government assistance programs can be a lifeline for those who struggle to afford dental care. By exploring these options, you can find financial relief and access to necessary dental treatments. Remember to research the eligibility criteria and requirements for each program to ensure you meet the qualifications.

Dental Credit Cards

If you’re looking for a convenient way to finance your dental care, consider applying for a dental credit card. Dental credit cards are specifically designed to help you cover the costs of dental treatments and procedures that may not be fully covered by insurance. These credit cards work just like regular credit cards, allowing you to make monthly payments for your dental expenses. They often come with promotional offers, such as zero percent interest or low-interest financing options, making them an attractive alternative to traditional credit cards or personal loans.

One of the main advantages of dental credit cards is their flexibility. Unlike other financing options, dental credit cards can be used exclusively for dental expenses, ensuring that you don’t mix your dental bills with other financial obligations. Additionally, some dental credit cards offer extended payment plans that allow you to spread out the cost of your treatments over a longer period of time, making them more affordable and manageable.

However, it’s important to carefully review the terms and conditions of any dental credit card before applying. Some cards may have high-interest rates or hidden fees that could end up costing you more in the long run. It’s also crucial to make sure that the dental providers you visit accept the specific dental credit card you choose.

Frequently Asked Questions

Are There Any Dental Financing Options Available for Individuals With Bad Credit or No Credit History?

Are there any dental financing options available for individuals with bad credit or no credit history?

Yes, there are options available. Even if you have bad credit or no credit history, you can still find dental financing options that can help you afford the dental care you need.

Some dentists offer in-house financing or payment plans, while others work with third-party financing companies that specialize in assisting individuals with less-than-perfect credit.

These options can make dental care more accessible and manageable for you.

How Do Dental Savings Plans Differ From Traditional Dental Insurance Plans?

Dental savings plans differ from traditional dental insurance plans in a few key ways. With a savings plan, you pay an annual fee and get discounted rates on dental services from participating providers. There are no deductibles or waiting periods, and pre-existing conditions are usually covered. Unlike insurance, there are no claim forms or maximum limits.

However, savings plans aren’t insurance and don’t provide the same level of coverage. It’s important to research and understand the specifics of each option before making a decision.

Can Government Assistance Programs Provide Coverage for Cosmetic Dentistry Procedures?

Government assistance programs typically don’t provide coverage for cosmetic dentistry procedures. These programs are usually designed to offer assistance for essential dental treatments, such as preventive care and basic dental procedures. Cosmetic dentistry, on the other hand, focuses on improving the appearance of your teeth rather than addressing health concerns.

Therefore, it’s unlikely that government assistance programs would cover procedures like teeth whitening or veneers. However, it’s always best to check with your specific program to see what they do and don’t cover.

What Are the Eligibility Criteria for Government Assistance Programs in Dental Care?

To find out the eligibility criteria for government assistance programs in dental care, you can start by contacting your local government office or visiting their website. They’ll have information on the specific requirements and documentation needed to apply for these programs.

It’s important to note that eligibility criteria may vary depending on your location and the specific program you’re applying for. Make sure to gather all the necessary information and follow the instructions provided to increase your chances of qualifying for assistance.

Are There Any Dental Credit Cards That Offer Rewards or Cashback Programs?

Yes, there are dental credit cards available that offer rewards or cashback programs.

These cards allow you to earn points or cashback on your dental expenses.

By using these cards, you can save money on your dental treatments while also earning rewards.

It’s a great way to make your dental care more affordable and get something extra in return.

Just make sure to compare different credit card options and choose the one that suits your needs best.

Conclusion

In conclusion, exploring patient financing options can help you find affordable dental care.

Dental insurance options, flexible payment plans, dental savings plans, government assistance programs, and dental credit cards are all viable options to consider.

By researching and understanding these options, you can make informed decisions to ensure you receive the dental care you need while managing your her latest blog finances effectively.

Don’t let cost be a barrier to your oral health take advantage of these resources and prioritize your dental care.

Welcome to my website! My name is Jacob Wearne, and I am thrilled to be your guide in the world of orthodontic innovations, pediatric dental care, cosmetic smile solutions, and dental technology trends. As a professional Orthodontic Innovations Specialist, I am passionate about transforming smiles and improving oral health for patients of all ages.